If you want to save the most money, the best way to get low-cost car insurance rates is to annually compare prices from insurers in Greensboro. Drivers can shop around by following these guidelines.

If you want to save the most money, the best way to get low-cost car insurance rates is to annually compare prices from insurers in Greensboro. Drivers can shop around by following these guidelines.

- Step 1: Gain an understanding of auto insurance and the measures you can take to prevent expensive coverage. Many rating factors that result in higher rates like careless driving and an imperfect credit score can be controlled by making minor changes in your lifestyle. This article provides more details to get cheaper rates and earn a bigger discount.

- Step 2: Request rate estimates from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can provide rates from one company like Progressive or Farmers Insurance, while independent agencies can quote rates for many different companies.

- Step 3: Compare the new rate quotes to your existing rates and see if you can save money. If you can save money and change companies, make sure coverage is continuous and does not lapse.

- Step 4: Tell your current agent or company to cancel your current car insurance policy. Submit a completed policy application and payment to your new carrier. As soon as you have the new policy, safely store the proof of insurance certificate in your vehicle.

A good piece of advice is that you’ll want to make sure you compare similar deductibles and liability limits on every quote and and to get price quotes from as many companies as you can. Doing this provides an apples-to-apples comparison and and a good selection of different prices.

It’s an obvious statement that auto insurance companies don’t want you to compare rates. People who shop for lower rates will, in all likelihood, switch auto insurance companies because they stand a good chance of finding a policy with more affordable rates. A recent survey discovered that people who did price comparisons regularly saved about $3,400 over four years compared to drivers who never compared prices.

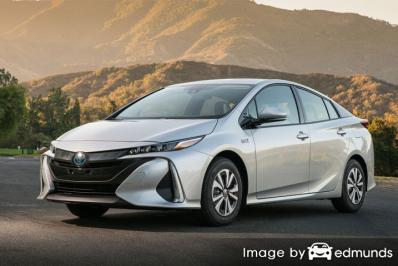

If finding the lowest price for Toyota Prius Prime insurance in Greensboro is your objective, then learning a little about the best ways to shop for insurance can make it easier to find better rates.

If you currently have a car insurance policy, you will surely be able to cut your premiums using the following tips. Locating the best insurance company for you in Greensboro is much easier if you know where to start. Nevertheless, North Carolina consumers need to have an understanding of how insurance companies calculate your policy premium.

Many insurance companies like Allstate and Progressive allow you to get coverage price quotes on their websites. Comparing Toyota Prius Prime insurance rates online doesn’t take much effort as you just enter your required coverages into a form. Behind the scenes, the company’s rating system automatically retrieves your driving and credit reports and returns a price based on many factors. Quoting online for Toyota Prius Prime insurance in Greensboro streamlines rate comparisons, and it’s very important to do this if you want to get the best possible rates on car insurance.

To find out how much you can save on car insurance, compare quotes from the companies shown below. If you currently have coverage, we recommend you enter your coverages identical to your current policy. Doing this assures you will have comparison quotes for exact coverage.

The companies in the list below provide price quotes in North Carolina. If multiple companies are listed, we recommend you visit two to three different companies to get a more complete price comparison.

Insurance is an important decision

Even though Greensboro Prius Prime insurance rates can get expensive, insurance is required in North Carolina but also provides important benefits.

- Most states have mandatory liability insurance requirements which means it is punishable by state law to not carry specific minimum amounts of liability protection in order to get the vehicle licensed. In North Carolina these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your Prius Prime has a lienholder, almost all lenders will require that you have comprehensive coverage to guarantee their interest in the vehicle. If you cancel or allow the policy to lapse, the bank or lender will purchase a policy for your Toyota for a lot more money and make you pay for the expensive policy.

- Insurance protects both your Toyota Prius Prime and your personal assets. Insurance will pay for many types of medical costs for yourself as well as anyone injured by you. Liability coverage also covers all legal expenses up to the policy limit if you are sued as the result of an accident. If you have damage to your Toyota as the result of the weather or an accident, your insurance policy will pay to restore your vehicle to like-new condition.

The benefits of carrying adequate insurance definitely exceed the price paid, specifically if you ever have a liability claim. According to a recent study, the average American driver is wasting up to $750 every year so it’s important to compare rates every year to make sure the price is not too high.

Save money by taking advantage of discounts

Insurance is not inexpensive, but you might find some hidden discounts that you may not know about. Larger premium reductions will be automatically applied when you quote, but once in a while a discount must be inquired about before you get the savings.

- Student Discounts – Being a good student can get you a discount of up to 25%. Most companies allow this discount up to age 25.

- Paperless Signup – Some companies will provide an incentive for buying your policy over the internet.

- Discount for New Cars – Adding a new car to your policy can save you some money because new vehicles are generally safer.

- No Claim Discounts – Good drivers with no accidents are rewarded with significantly better rates on Greensboro car insurance quote when compared with bad drivers.

- Multi-Vehicle Discounts – Purchasing coverage when you have multiple cars or trucks with the same insurance company can get a discount for every vehicle.

- Safety Restraint Discount – Using a seat belt and requiring all passengers to wear their seat belts can save up to 15% off PIP or medical payments premium.

- Multi-policy Discount – If you can combine your homeowners and auto policy with one company you may earn as much as 10 to 15 percent.

One last thing about discounts, most credits do not apply to the entire cost. Most cut specific coverage prices like physical damage coverage or medical payments. So when it seems like you would end up receiving a 100% discount, you won’t be that lucky.

Some of the insurance companies that possibly offer these benefits include:

When getting free Greensboro car insurance quotes, it’s a good idea to each insurance company which discounts can lower your rates. Some of the discounts discussed earlier may not be offered in your area.

Best auto insurance company in Greensboro

Buying coverage from the best car insurance company is hard considering how many choices you have in Greensboro. The ranking data below can help you analyze which auto insurance companies to look at when shopping around.

Top 10 Greensboro Car Insurance Companies Ranked by Claims Service

- Travelers

- Nationwide

- Allstate

- State Farm

- Liberty Mutual

- GEICO

- American Family

- Esurance

- Titan Insurance

- AAA Insurance