Everyone knows that car insurance companies want to prevent you from shopping around. People who get comparison quotes at least once a year are inclined to buy a new policy because there is a significant possibility of finding a lower-priced company. A recent survey revealed that drivers who shopped around every year saved $72 a month compared to other drivers who never shopped for cheaper rates.

If finding the cheapest rates on insurance is your goal, then having a grasp of how to get price quotes and compare insurance rates can make it easier to find better rates.

If you want to save the most money, the best way to find cheaper prices for auto insurance rates in Greensboro is to begin comparing prices regularly from different companies who can sell car insurance in North Carolina.

If you want to save the most money, the best way to find cheaper prices for auto insurance rates in Greensboro is to begin comparing prices regularly from different companies who can sell car insurance in North Carolina.

- Get a basic knowledge of the different coverages in a policy and the modifications you can make to keep rates in check. Many rating criteria that are responsible for high rates such as at-fault accidents, careless driving, and a less-than-favorable credit score can be eliminated by paying attention to minor details. Continue reading for tips to help reduce prices and find possible discounts that are available.

- Compare price quotes from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can give quotes from a single company like GEICO or Farmers Insurance, while independent agents can provide rate quotes from multiple companies. Begin your rate comparison

- Compare the new rates to the premium of your current policy to see if a cheaper price is available in Greensboro. If you find a lower rate quote and make a switch, verify that coverage does not lapse between policies.

One important bit of advice is to make sure you enter the same physical damage deductibles and liability limits on each quote request and and to get quotes from all possible companies. Doing this enables a fair rate comparison and a complete rate analysis.

If you have a current insurance policy or just want cheaper coverage, use these cost-cutting techniques to find the best rates without reducing protection. Locating the most cost-effective insurance policy in Greensboro can be easy if you know a few tricks. Smart buyers just need to understand the most effective way to shop their coverage around using one simple form.

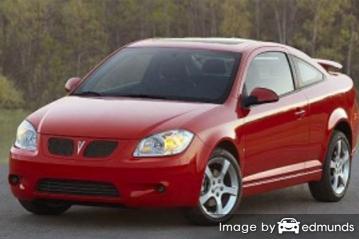

Companies offering Pontiac G5 insurance in North Carolina

The providers in the list below can provide comparison quotes in Greensboro, NC. If you want to find the best cheap car insurance in Greensboro, we recommend you visit several of them to find the most affordable auto insurance rates.

Car insurance discounts are available to cut your rates

Some providers don’t list their entire list of discounts in a way that’s easy to find, so the list below details both well-publicized and the more hidden credits available to bring down your rates.

- Switch and Save Discount – A few larger companies give discounts for switching companies prior to your current G5 insurance policy expiring. It’s a savings of about 10%.

- Paperwork-free – Certain companies will give you a small discount for completing your application over the internet.

- No Accidents – Drivers with accident-free driving histories pay much less in comparison with accident-prone drivers.

- Life Insurance – Larger car insurance companies have better prices if you take out a life policy as well.

- Discount for Low Mileage – Driving less may allow you to get substantially lower car insurance rates.

- 55 and Retired – Seniors may be able to get reduced rates.

- Defensive Driver – Participating in a safe driver course could earn you a small percentage discount if you qualify.

- Discount for Good Grades – This discount may save as much as 25% on a Greensboro car insurance quote. The good student discount can last until age 25.

- Theft Prevention System – Vehicles with anti-theft systems help deter theft and will qualify for a discount on a Greensboro car insurance quote.

Discounts save money, but please remember that most discount credits are not given to the entire cost. Most cut individual premiums such as medical payments or collision. Despite the appearance that you can get free auto insurance, companies don’t profit that way. Any amount of discount will cut your policy cost.

If you would like to see a list of companies with the best discounts in Greensboro, follow this link.

Do I need special coverages?

When selecting adequate coverage, there is no perfect coverage plan. You are unique so your insurance should reflect that Here are some questions about coverages that may help highlight if your insurance needs might need professional guidance.

- Do I need PIP coverage since I have good health insurance?

- Why am I be forced to buy a membership to get insurance from some companies?

- Is my trailer covered?

- Will my insurance pay for OEM parts?

- Is other people’s property covered if stolen from my vehicle?

- What is UM/UIM insurance?

- Does my policy cover me when driving someone else’s vehicle?

- Why are teen drivers so expensive to add on to my policy?

If you don’t know the answers to these questions but you think they might apply to your situation, you might consider talking to an agent. To find lower rates from a local agent, fill out this quick form or click here for a list of car insurance companies in your area. It’s fast, free and can help protect your family.

Local neighborhood agents and car insurance

Certain consumers still like to sit down and talk to an agent and that is not a bad decision Licensed agents can make sure you are properly covered and help you file claims. An additional benefit of comparing rate quotes online is that you can find cheap car insurance quotes but also keep your business local. Putting coverage with local agencies is important especially in Greensboro.

To find an agent, once you fill out this form (opens in new window), the coverage information is emailed to participating agents in Greensboro who will give you bids for your insurance coverage. You won’t need to leave your computer as quotes are delivered to you. If you want to get a comparison quote from one company in particular, feel free to jump over to their website and give them your coverage information.

To find an agent, once you fill out this form (opens in new window), the coverage information is emailed to participating agents in Greensboro who will give you bids for your insurance coverage. You won’t need to leave your computer as quotes are delivered to you. If you want to get a comparison quote from one company in particular, feel free to jump over to their website and give them your coverage information.

When searching for a local insurance agency, it’s helpful to know the types of insurance agents and how they can service your needs differently. Car insurance policy providers can be described as either exclusive or independent (non-exclusive). Either can do a good job, but it’s good to learn the difference between them since it could factor into the type of agent you choose.

Independent Car Insurance Agents

These type of agents do not have single company limitations so as a result can place your coverage with many different companies and help determine which has the cheapest rates. To transfer your coverage to a different company, the agent simply finds a different carrier and that require little work on your part. When comparing rates, it’s a good idea to compare quotes from independent agents in order to compare the most rates.

Listed below are independent agencies in Greensboro who can help you get comparison quotes.

Nationwide Insurance: Chris Baughan

3225 Battleground Ave – Greensboro, NC 27408 – (336) 286-3303 – View Map

Nationwide Insurance: Jenkins Insurance Agency Inc

3907 W Market St a – Greensboro, NC 27407 – (336) 854-7900 – View Map

Nationwide Insurance: Michael Bare Agency

2828 Battleground Ave Ste C – Greensboro, NC 27408 – (336) 282-5033 – View Map

Exclusive Car Insurance Agents

These type of agents work for only one company and some examples include Farmers Insurance, Allstate, or State Farm. Exclusive agents cannot compare other company’s rates so it’s a take it or leave it situation. These agents are well schooled on their company’s products and that can be a competitive advantage.

The following are exclusive insurance agents in Greensboro willing to provide price quote information.

Allstate Insurance: John F Davis

3800 S Holden Rd #101 – Greensboro, NC 27406 – (336) 299-9100 – View Map

Keith Kepler – State Farm Insurance Agent

1603 Westover Terrace a – Greensboro, NC 27408 – (336) 294-4341 – View Map

Allstate Insurance: Brad Williams

4125 Walker Ave C – Greensboro, NC 27407 – (336) 852-2627 – View Map

Finding the right auto insurance agent should depend on more than just the quoted price. Here are some questions you should ask.

- Is the coverage adequate for your vehicle?

- Is there a Errors and Omissions policy in force?

- Is the quote a firm price?

- What are their preferred companies if they are an independent agency?

- Do they regularly work with personal auto policies in Greensboro?

- Do they have designations such as AIC, CPCU, or CIC?

Do the work, save more money

As you shop your coverage around, it’s very important that you do not buy less coverage just to save a little money. There are a lot of situations where consumers will sacrifice physical damage coverage only to discover later that the small savings ended up costing them much more. The aim is to buy the best coverage you can find at the lowest possible cost while still protecting your assets.

Cheaper Pontiac G5 insurance in Greensboro can be sourced on the web and from local insurance agents, and you should be comparing both to have the best chance of lowering rates. A few companies may not have the ability to get quotes online and usually these smaller companies only sell through local independent agents.

For more information, link through to the following helpful articles:

- Keeping Children Safe in Crashes Video (iihs.org)

- How Much are Car Insurance Quotes for First-time Drivers in Greensboro? (FAQ)

- Who Has Affordable Auto Insurance Rates for a 20 Year Old Male in Greensboro? (FAQ)

- Who Has Affordable Car Insurance for a Honda Accord in Greensboro? (FAQ)

- Credit Impacts Car Insurance Rates (State Farm)

- Insuring a Leased Car (Insurance Information Institute)

- Cellphones, Texting and Driving (iihs.org)

- Credit and Insurance Scores (Insurance Information Institute)